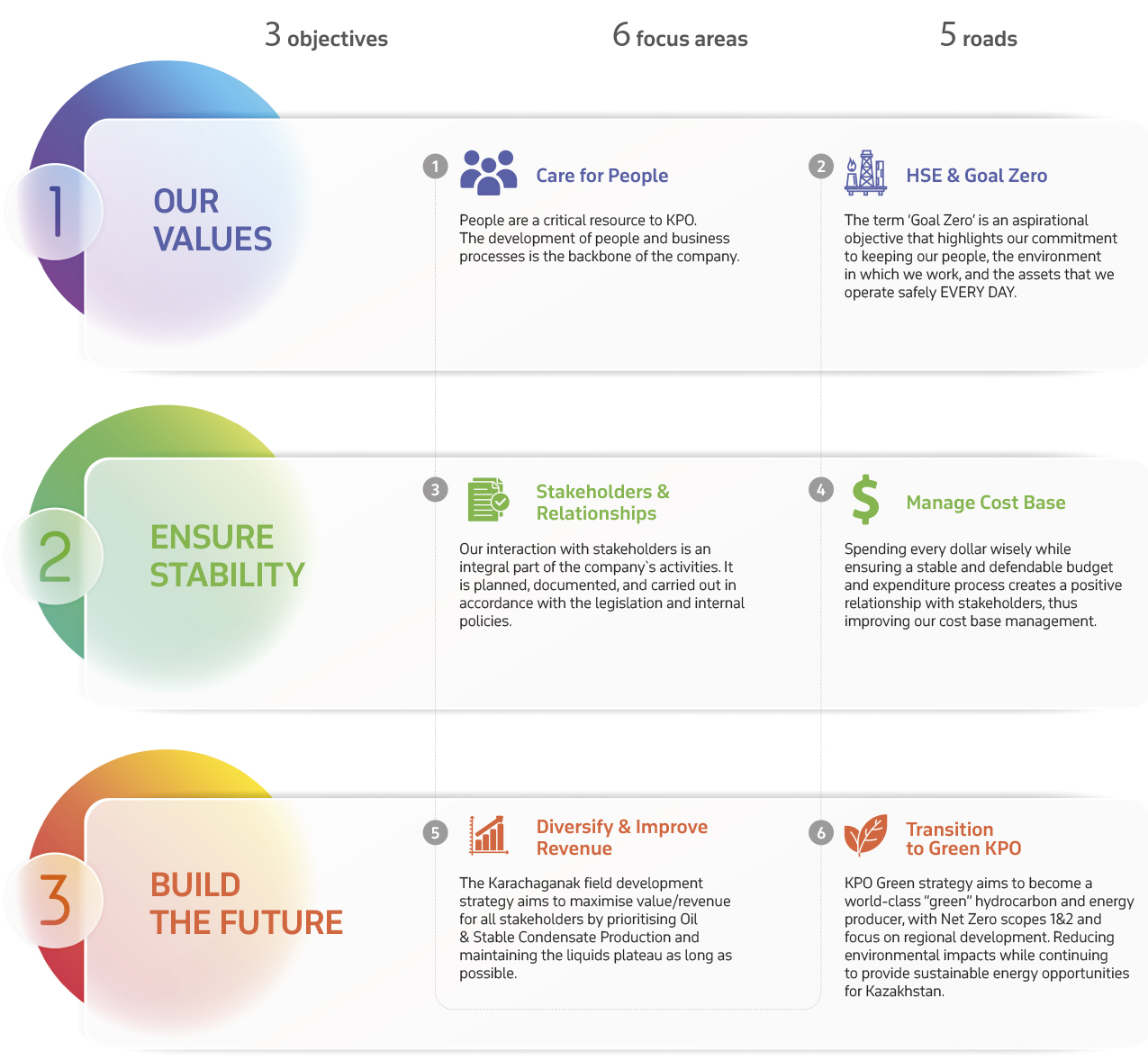

There are “3” objectives in KPO 365. They are intended to remain stable year on year. These are the core foundations that set up the rest of the 365 strategy and they are the driving force behind making KPO a world-class producer, that is resilient and sustainable.

There are the “6” focus areas in KPO 365 which are intended to remain stable with updates on a 3-yearly cycle if required.

There will be “5” roads for each focus area in KPO 365, which will be the annual short-term strategies developed to progress KPO’s long-term vision. They are planned to be reviewed and confirmed/updated annually, and then to be linked to the annual KPI’s and become the input to the business planning updates that follow.

OUR MISSION

Mission of the Karachaganak Petroleum Operating B.V. is to develop the Karachaganak Field in an environmentally and economically sound manner while simultaneously creating the socio-economic development opportunities for local communities.

To support the achievement of our mission, we continue embedding sustainable development thinking into the way we do business. This means that in all our activities we shall:

- look to minimise impacts and maximise opportunities linked with its presence;

- consider the consequences of our decisions in the long-term;

- engage our stakeholders in a constructive dialogue;

- incorporate strong governance and transparency.

Guided by the principles of sustainable development established in the KPO Sustainable Development Charter, as well as the KPO Business Principles, the Company conducts its activities by contributing to the achievement of the UN sustainable development goals and objectives.

KPO BUSINESS STRATEGY

The KPO mission reflects our commitment to ensuring long term social, environmental and economical sustainability, which we plan to achieve through executing our “KPO 365 Strategy”, consisting of – 3 objectives, 6 focus areas and 5 roads (see fig. 1).

The objective of the KPO Business Strategy is to ensure there is alignment across the organisation on the Mission and an understanding of the framework designed to keep KPO on track to deliver on our promises.

Translating the Vision and Mission into tactical, tangible activities is critical in helping the organisation deliver on the strategic objectives. This is achieved through the embedding of the KPO Corporate Strategy ‘KPO 365’. This strategy sets out the ‘Building Blocks’ that will position KPO for success in the future and is shown on fig. 1.

Fig. 1.KPO 365 Strategy

Climate-related risks and opportunities

We are consistently improving our approach to assessing and managing the risks and opportunities arising from climate change. This involves considering various time horizons and their relevance to risk identification and business planning. We actively monitor regulatory changes related to emissions trading systems, carbon pricing, renewable energy, and offsetting. These factors are incorporated into our potential scenarios that offer insights into how the energy transition might evolve in the medium and long terms. These insights guide our strategic vision, funds allocation, and GHG reduction targets.

We are working to effectively adapt our assets and operations to enhance our resilience to the physical risks related to climate change where needed. Activities are underway to protect assets and personnel from the physical impact of climate risks. In March-April 2024, KPO supported local authorities of the Burlin district of the West Kazakhstan Oblast on the construction of flood barriers and helped citizens who had suffered from flooding. KPO provided free financial aid worth KZT 2 bln for people, who lost housing in floods.

We are also collaborating with RoK Government by participating in various working groups to contribute in establishing regulatory frameworks that will enable us to achieve the Paris Agreement‘s goals.

In March 2024, KPO has joined the international Oil & Gas Methane Partnership (OGMP) 2.0 initiative, a comprehensive reporting system based on accurate emissions measurements. OGMP 2.0 is the UNO Environment Programme’s flagship initiative aimed at improving reporting and reducing methane emissions in the O&G industry.

As a leading oil and gas company in RoK, KPO seeks to identify risks and opportunities in the energy transition beforehand.

Commercial risk (medium and long term)

The shift to a low-carbon economy and the possible extension of the EU cross-border carbon regulation (Carbon Border Adjustment Mechanism) to oil and gas might result in decreased sales volumes and/or profit margins due to the high energy-intensity of oil and gas products. Additionally, evolving preferences among investors and financial institutions could limit access to capital and raise its cost.

Regulatory risk (short, medium and long)

Kazakhstan’s carbon market, as well as other markets, aims at a systematic transition of businesses to low-carbon technologies, by reducing the free quota on GHG emissions and developing of emissions trading system. Compliance costs are expected to increase due to the enhancement in carbon regulation. However, currently there a big uncertainty around carbon quota reduction rate, carbon pricing and other regulatory mechanisms. This makes it harder to determine the appropriate assumptions to be taken into account in projects planning and investment decision processes.

Physical risks (short, medium and long)

The potential impact of climate changes comes from risks, such as flooding and droughts, and high temperatures during the summer which could potentially impact KPO’s facilities, operations and supply chain. The frequency of these hazards and impacts is expected to increase. Extreme weather events, whether or not related to climate change, could have a negative impact on KPO’s financial condition.

Reputational risks (long-term)

In terms of reputational risks, KPO, if not recognised as one of the Climate Change champions, may potentially suffer from however intangible reputational risks. This highlights the need for each business to join and share the common responsibility across the O&G industry. Therefore, KPO’s contribution to the all-out industry-wide effort should be visible and recognisable. This implies the pursuit of the best available technologies, practices and initiatives both in-house and borrowed from KPO Parent Companies, most of whom have already made a tremendous leap in their operational ethos in terms of energy transition.

Energy transition also brings opportunities for KPO to benefit from changing regulations and customer demand. As we strive to deliver greater value with fewer emissions, currently we are focusing on energy efficiency, renewable energy, nature-based offsetting opportunities and methane emissions control. Enhancing energy efficiency and incorporating renewable energy sources will help us reducing greenhouse gas emissions and the carbon footprint of our products. This will ensure compliance with legislation, prevent potential overage charges, and maintain our competitiveness. Carbon offsets play an immediate and valuable role as a bridge to the future of decarbonization in the short to mid-term as other solutions ramp up. More details are provided in the Climate Change and Energy Transition section of this Report.

Beyond that, controlling methane emissions is essential for several reasons, mainly because of methane’s significant impact on climate change and air quality. Implementing effective monitoring systems can further enhance the reporting process and prevent the release of methane into the environment. Enhanced monitoring of methane emissions and transparent reporting are our top priorities for the next five years, from 2024 to 2029.